Initial concepts

This is the term used to refer to intermediaries or insurance brokers who facilitate the hiring of cargo insurance between the INSURED and the INSURANCE COMPANY, as well as related services.

Also known as merchandise insurance, is an agreement established in a document called an insurance policy, in which an insurance company (INSURER) commits, through the payment of an insurance premium, to indemnify or compensate for losses, damages, or harm incurred in the event of an accidental occurrence during the transportation of the insured goods, as previously agreed with the INSURED.

The Policyholder is the person who contracts the insurance with the insurance company and commits to paying the premium. In many cases, the policyholder is also the insured. If the policyholder and the insured are different persons, the obligations and duties arising from the contract fall on the policyholder, except for those that, by their nature, must be fulfilled by the insured.”

A beneficiary is the person designated in the policy by the insured or policyholder as the holder of the indemnity rights established in the document. The beneficiary can be designated expressly or implicitly, and the choice is generally made freely. However, it is common for the beneficiary to have some kind of personal, family, or financial relationship with the insured or policyholder.

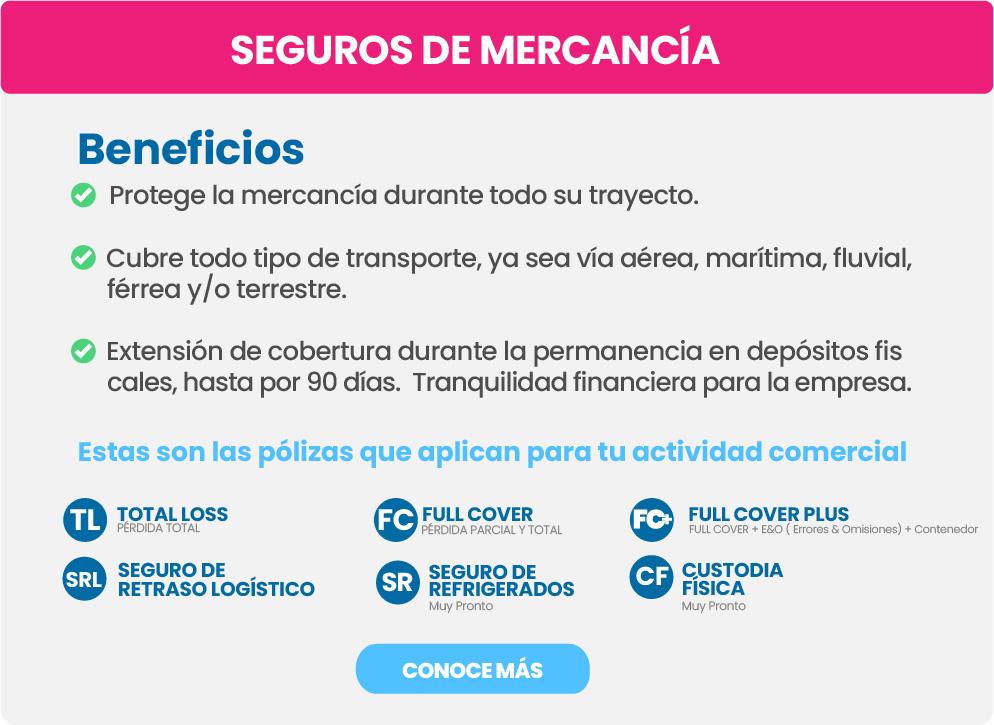

Marine cargo insurance

It is the value on which the insurable interest is held, i.e., the value of the goods to be insured in the insurance policy. In other words, it is the ascertainable value of the insured goods.

It is the document that serves as proof of the acquisition of an insurance policy, in which the general characteristics of the insured values and the coverages included in the service are defined.

Insurable interest refers to the relationship that exists between the policyholder and the insured item, in this case, the cargo. This implies that the insured has an interest in preventing the occurrence of the loss.

Coverage

Coverage is the main obligation of the insurer in an insurance contract. Consists of taking charge, up to the limit of the sum insured, of the economic consequences arising from a loss.

Those are the nations that are excluded by the OFAC (Office of Foreign Assets Control) list, and therefore insurance coverage cannot be granted for goods with origin or destination in those countries. These restrictions are imposed by the laws of Mexico, the United States of America, and resolutions issued by the United Nations, or by commercial limitations imposed by the Office of Foreign Assets Control of the U.S. Department of the Treasury.

The countries in question, effective as of 2023, are: Afghanistan, Albania, Algeria, Angola, The Balkans (Bosnia, Herzegovina, Bulgaria, Slovenia, Macedonia, Romania, Kosovo), Belarus, Burma (Myanmar), Chad, North Korea, Ivory Coast, Croatia, Crimea, Cuba, Eritrea, Ethiopia, Georgia, Persian Gulf and adjacent waters including Gulf of Oman, Guinea, Iraq, Iran, Russian Federation, Israel and Red Sea coasts, Laos, Lebanon, Liberia, Libya, Libya, Montenegro (Former Yugoslavia), Nigeria, Pakistan, Qatar, Central African Republic, Democratic Republic of Congo, Serbia, Sierra Leone, Syria, Somalia, Sri Lanka, North Sudan, Ukraine, Uzbekistan, Venezuela, Yemen, Zaire, Zimbabwe.

The deductible corresponds to the participation value that the insured party has as a result of a loss or claim, by deducting or paying an amount from the total amount agreed with the insurer.

Accident

A “loss” refers to unforeseen situations that can cause harm, damages, and losses, whether total or partial, to the insured goods during the term of the insurance policy.

ROT stands for Ordinary Risks of Transportation. It refers to the basic risks that can occur during the transportation of goods, such as theft, strikes, Malicious acts by third parties, and loading and unloading operations.

Gross Average is the principle of maritime law where the sacrifice of cargo or extraordinary expenses incurred by the ship’s captain to safeguard the vessel, the majority of the cargo, and the crew losses are shared proportionally among all parties with insurable interest in the vessel. In the event of a general average, all stakeholders must contribute proportionally to the payment of expenses and losses incurred.

Other insurance concepts

Reinsurance, also known as “insurance for insurers,” is a contract in which an insurance company transfers part or all of the risks it has assumed to a third entity called a reinsurer. The reinsurer takes on a portion of the potential losses in exchange for a compensation or payment known as a reinsurance premium.

Co-insurance is a contract in which multiple insurance companies decide to join together to insure large events that, on their own, would pose a high risk for a single insurer and, in many cases, would exceed the limits supported by individual insurances.

Subrogation is the act by which one person replaces another in the rights and obligations of a particular legal relationship. In the context of an insurance contract, subrogation allows the insurer to take the place of the insured in pursuing actions or rights against third parties responsible for the accident or loss, with the aim of recovering the amount for which they should be held civilly liable for the damages caused. This compensation, as stipulated in the insurance policy, is initially covered by the insurance company.

Underinsurance is a situation that occurs when the sum insured is less than the actual value of the asset to be insured. That is, the value stipulated in the insurance policy is less than the actual value of the insured merchandise. In the event of an accident, the compensation received will be less than the actual value of the cargo, which may generate economic damage for the insured.

Overinsurance is a situation that occurs when the value attributed by the insured to the insured goods is higher than their actual value. In this case, the insured item is overvalued or overinsured, which may lead to the insurance company denying payment of any compensation that exceeds the actual value of the insured object.